*When you purchase this bundle, you will receive a coupon code for 25% off your first coaching session!

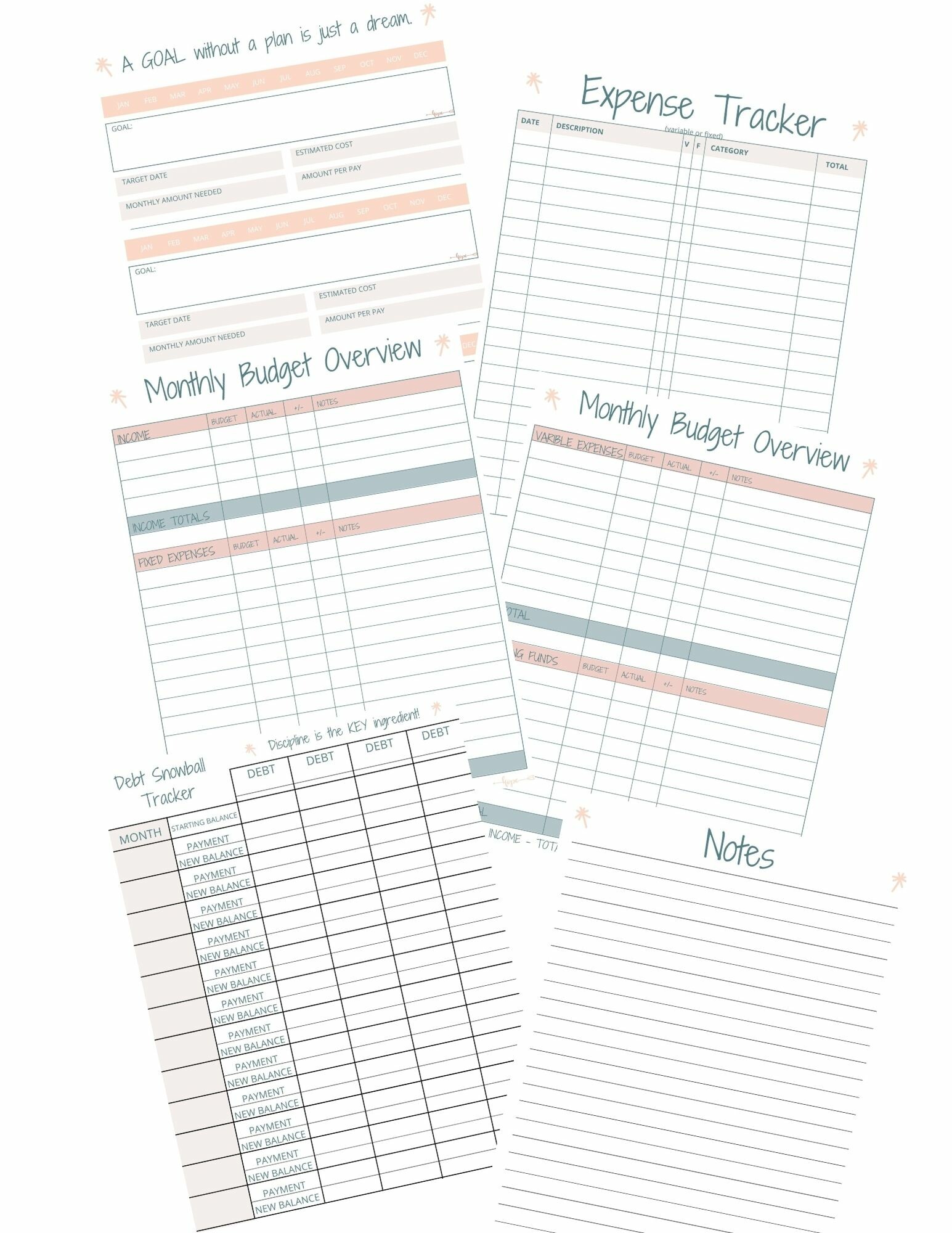

Personal Goal Setting and Budgeting Worksheets - $17

"A goal without a plan is just a dream." ~ Dave Ramsey

If you need that plan, look no further!

These worksheets will set you up with a fast track to success.

Here's what you'll get:

These worksheets will set you up with a fast track to success.

Here's what you'll get:

- Goal Setting Worksheet

- Income Budget

- Expense Budget

- Budget Summary

- Subscriptions & Memberships

- Expense Tracker

- Expense Summary

- Monthly Bill Calendar

- Payment Tracker

- Monthly Budget Overview

- Paycheck Budget Worksheet

- Monthly Goals

- Debt Snowball Tracker

- Savings Tracker

- Notes

- 5 Printable Cash Envelopes

I started my own personal deb payoff journey in October of 2019. I had been 'trying' to pay off my debt for 20 years prior, and was never able to make any progress. My money was leaving faster than it was coming in, and I had no idea where it was going! It wasn't until I learned the importance of budgeting, tracking your spending, and telling your money where to go, that I started to see progress. Not counting my mortgage, I started with just over $32,000 in consumer debt. I will be completely consumer debt free by November of 2021, or sooner!

I attribute it solely to the fact that I began to use worksheets, taking pen to paper each and every month, to become fully aware of how I was spending my money. This allowed list out my goals, and make sure that my spending was getting my closer to reaching those goals.

I attribute it solely to the fact that I began to use worksheets, taking pen to paper each and every month, to become fully aware of how I was spending my money. This allowed list out my goals, and make sure that my spending was getting my closer to reaching those goals.

Check out this powerful testimony from Jennifer:

"One year ago Nicole starting posting videos on Facebook. It was talking about some of her financial journey, and some of the new things she was putting in place. There was talk of budgeting, and cash envelopes, and tracking things. It all sounded very overwhelming to me.

I was happy, and interested to hear of the progress she was making in her own life, but I thought that’s not for me!! That’s only for people who have enough to make ends meet, only for people that made all kinds of extra money that they could pay things down. I was living paycheck to paycheck. Credit cards were there for emergencies - but it seemed one emergency after another. We couldn’t afford to pay any extra, and I was sick to my stomach worrying about the next emergency that would crop up.

I figured I would listen to what she had to say, and maybe in the future - when things changed- maybe I could use that info then. As I was listening one day, she said something that changed my whole view on finances. Something that could make this possible, even for me in my situation. She said something along the lines of - This is a plan for the money you already have. You don’t need to make more money to pay down debt. Could that actually be true?

Well I can tell you 100 percent yes!

2020 was a doozy of a year, but never in a million years could I have imagined my financial life to be where it is right now. We have paid OFF 4 of our 5 credit cards. The 5th will be paid off by the end of January. We are on a fast track to have our Mortgage paid off in 6 years and 9 months. I paid cash to fill my heating fuel tank. I just bought a new piece of living room furniture. A birthday comes up, and no big deal - here’s the cash.

How could I have thought that a budget was overwhelming, and oppressive when really it’s empowering, and freeing?! She did a 2 month workshop in February(?) So all of this has happened in less than 1 year. It blows my mind. I am so thankful to Nicole for literally changing my life!!!"

Jennifer P.

"One year ago Nicole starting posting videos on Facebook. It was talking about some of her financial journey, and some of the new things she was putting in place. There was talk of budgeting, and cash envelopes, and tracking things. It all sounded very overwhelming to me.

I was happy, and interested to hear of the progress she was making in her own life, but I thought that’s not for me!! That’s only for people who have enough to make ends meet, only for people that made all kinds of extra money that they could pay things down. I was living paycheck to paycheck. Credit cards were there for emergencies - but it seemed one emergency after another. We couldn’t afford to pay any extra, and I was sick to my stomach worrying about the next emergency that would crop up.

I figured I would listen to what she had to say, and maybe in the future - when things changed- maybe I could use that info then. As I was listening one day, she said something that changed my whole view on finances. Something that could make this possible, even for me in my situation. She said something along the lines of - This is a plan for the money you already have. You don’t need to make more money to pay down debt. Could that actually be true?

Well I can tell you 100 percent yes!

2020 was a doozy of a year, but never in a million years could I have imagined my financial life to be where it is right now. We have paid OFF 4 of our 5 credit cards. The 5th will be paid off by the end of January. We are on a fast track to have our Mortgage paid off in 6 years and 9 months. I paid cash to fill my heating fuel tank. I just bought a new piece of living room furniture. A birthday comes up, and no big deal - here’s the cash.

How could I have thought that a budget was overwhelming, and oppressive when really it’s empowering, and freeing?! She did a 2 month workshop in February(?) So all of this has happened in less than 1 year. It blows my mind. I am so thankful to Nicole for literally changing my life!!!"

Jennifer P.

I want you to be completely satisfied with your purchase. While I am not able to offer refunds as this is an instant digital download, you are welcome to contact me if you have any problems with your order.